By Ted Gonder, Moneythink co-founder and executive director

By Ted Gonder, Moneythink co-founder and executive director

Elevator Pitch: Moneythink is a White House-recognized organization that is expanding economic opportunity in the United States by mobilizing college students to equip high school youth to believe in themselves, navigate the financial decisions of adulthood and achieve financial prosperity. Moneythink is transforming the financial literacy landscape through an action-focused, pop culture curriculum with a heavy focus on impact metrics.

Description

Moneythink trains and mobilizes college students to provide mentorship based upon an innovative pop culture curriculum that teaches applicable financial capability skills and concepts.

Moneythink mentors deliver the Moneythink program to partner schools once-a-week over a course of an academic year. The mentorship model is student-initiated, ensuring a large degree of ownership by the student. The emphasis on mentorship creates trust between the mentor and the student, and establishes meaningful long-term relationships.

The pop culture curriculum derives real-world examples from the music industry, sports, current events, entertainment and media. The curriculum is designed to drive classroom and student engagement.

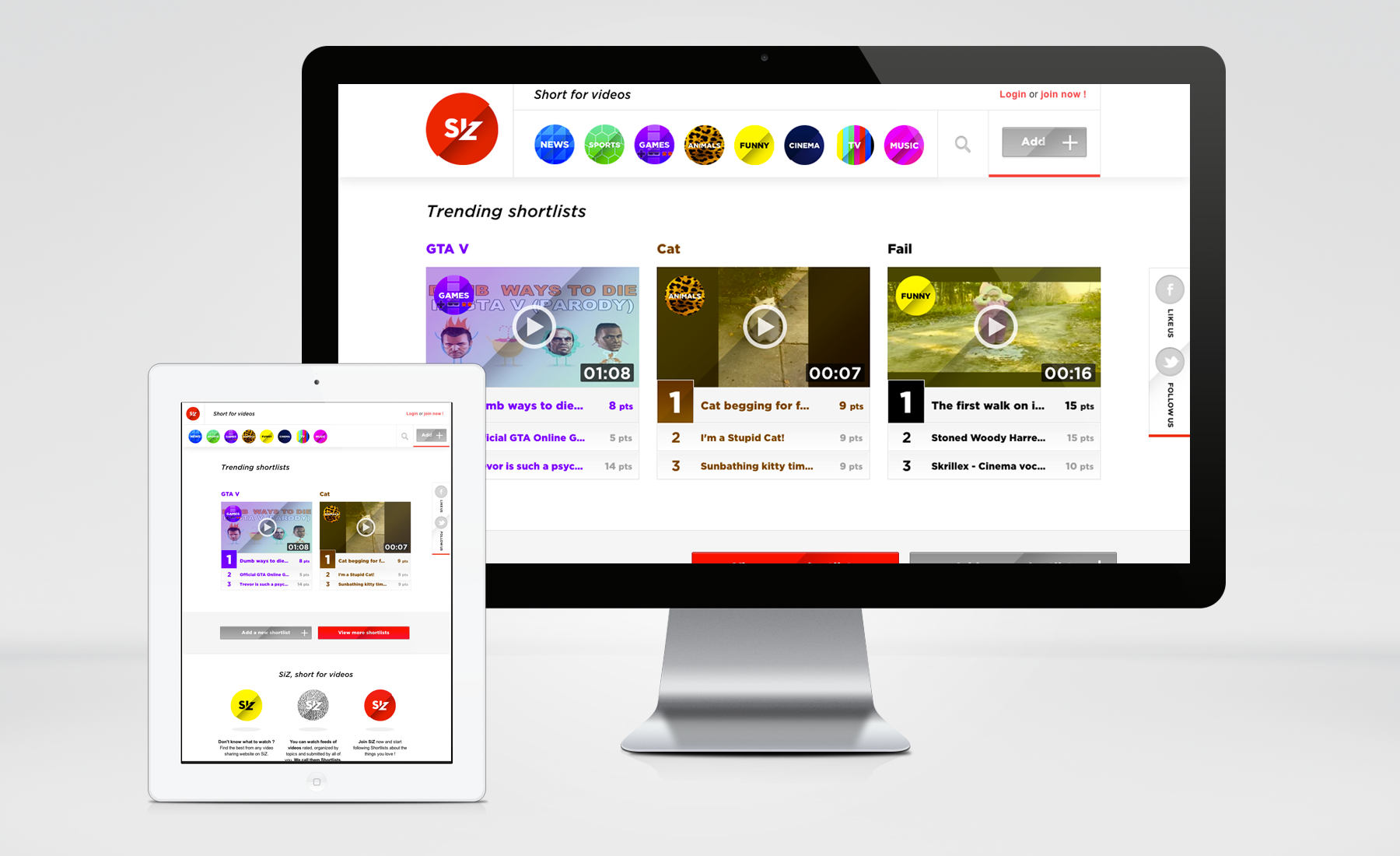

Moneythink also encourages technology use and is developing technologies that will take mentorship to the next level.

Serial reciprocity drives me. My parents grew up with nothing and gave up a lot so that I could have all the opportunities they never had. In high school, a college mentor tutored me in math—and in life, turning my “mirrors into windows” (as Henry David Thoreau would say). I believe that my ancestral obligation and life mission is to seize opportunity and spread it for others, helping to even the odds for future generations.

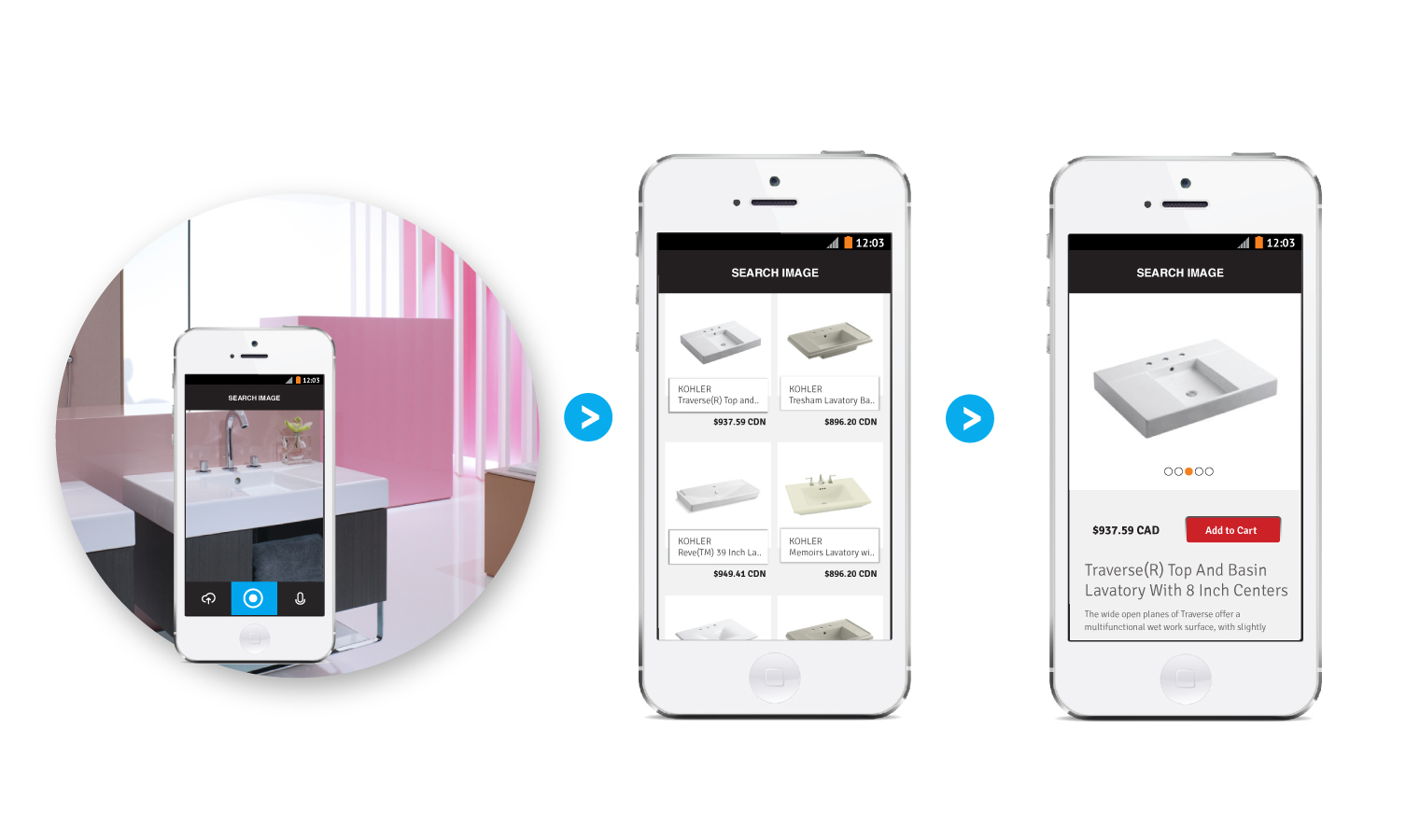

So, in 2008, when the economy collapsed, my friends at U. Chicago and USC thought “how can we as college students make a local, tangible impact on this seemingly intractable global financial crisis?” We put our heads together and realized that we could mobilize the motivated college students on our campuses in business and economics to tutor local high school students on a practical subject such as money. When we got in the classrooms, we focused on building relationships with our students and understanding their relationship to money and culture. Students came back to us and asked us to come back, one student saying “this is my way out; I’m not getting this information from anyone else in my life.” Quickly, college students at Stanford, UCLA, and Claremont heard about the volunteer initiative and wanted to launch chapters of their own. Recently, we’ve partnered with IDEO.org to build a mobile app that extends our students’ financial mentoring and learning experience outside the classroom.

Moneythink was recognized by President Obama as one of five national ‘Campus Champions of Change.’ We also recently received the national 2013 Yoshiyama Young Entrepreneur Award, and are one of five top finalists to win the highest prize of MassChallenge, the world’s largest startup accelerator.

http://youtu.be/DAifsTMYCZQ

Addressable Need

Moneythink has an incredible opportunity in the market because financial education is not being adequately taught to our nation’s youth. The lack of an effective curriculum, along with applicable and tangible results, places Moneythink as a recognized leader in the field of financial education. We are equipping teens (many of whom are at-risk youth) with the knowledge to become responsible and innovative consumers, investors and entrepreneurs.

How Moneythink Is Different

Moneythink is the only movement of young people working to restore the economic health of the United States through financial education, as well as the only financial literacy education program to rely upon college volunteers. Moneythink looks beyond just financial literacy in financial education, and addresses financial capability. Moneythink encourages and teaches real-world application of financial concepts. The pop culture curriculum and mentorship model encourages high ownership by the students. Lastly, Moneythink leverages data-driven insights to measure and maximize its impact so that Moneythink can continue towards its long-term vision of bringing financial capability to all of the youth in America.

Moneythink’s Needs

Moneythink is currently in the midst of scaling its mentorship program and expanding partnerships with schools across the country. Moneythink also recently began a project with IDEO.org to build a mobile smartphone app to bring the learning experience for students beyond the classroom. Both of these initiatives require funding, both for the development and expansion. As a non-profit, Moneythink depends on donations and funds for operations and expansion.

Moneythink also needs more student leaders and volunteers to start chapters at their schools and commit to mentoring high school youth in critical financial capability skills.

# # #

Headquarters: Chicago

Headquarters: Chicago

Website: www.moneythink.org

Founder: Ted Gonder

Backers: Center for Financial Services Innovation, Blackstone Charitable Foundation, Pimco Foundation, BMO Harris Bank, MassChallenge, Hitachi Foundation

Year Founded: 2008

Employees: 3

Twitter: @moneythink

Facebook: facebook.com/moneythink

LinkedIn: linkedin.com/company/2803337

AngelList: angel.co/moneythink-1