A Q&A with The Zebra co-founder and CEO Adam Lyons. The Austin, Texas-based startup, which is a comprehensive online auto insurance marketplace for the U.S., announced the closing of a $3 million Seed funding round in early December. Investors include Mark Cuban and British entrepreneur Simon Nixon. It was founded in 2012.

A Q&A with The Zebra co-founder and CEO Adam Lyons. The Austin, Texas-based startup, which is a comprehensive online auto insurance marketplace for the U.S., announced the closing of a $3 million Seed funding round in early December. Investors include Mark Cuban and British entrepreneur Simon Nixon. It was founded in 2012.

SUB: Please describe The Zebra and your primary innovation.

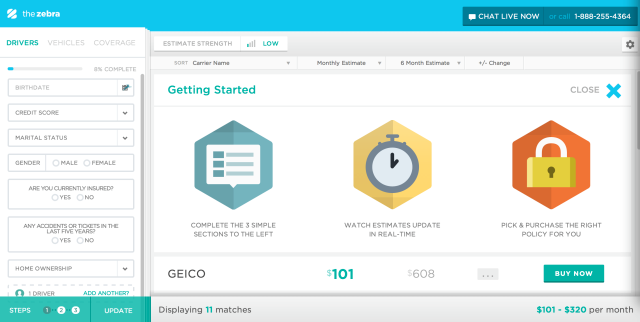

Lyons: TheZebra.com is the most comprehensive car insurance comparison platform in the U.S. For the first time, users can determine the right coverage, compare hundreds of car insurance companies apples-to-apples, purchase their policy, and then manage their insurance in one place. We are the first company to compare all the major carriers as well as regional brands in one platform, providing results in seconds without asking for any personal information.

SUB: Who are your target markets and users?

Lyons: There are $180 billion of auto insurance premiums written in the U.S. every year. We live online, yet there still isn’t a way folks can compare all the major insurance companies and instantly purchase their policy. We target the rapidly-growing demographic of drivers who use the Internet for financial transactions.

SUB: Who do you consider to be your competition, and what differentiates The Zebra from the competition?

SUB: Who do you consider to be your competition, and what differentiates The Zebra from the competition?

Lyons: There’s no question that shopping for car insurance is difficult and time consuming. But many companies invest in outbound marketing rather than educating consumers on how insurance really works. For that reason, I think that our biggest competition is actually the lack of transparency in the auto insurance space. Because every driver is different and priced unique to their profile, it’s more complex than aggregating flights. It’s not just a seat on a plane—there’s no ‘economy class’ insurance carrier. To get the best deal, you have to compare hundreds of companies, not just a few. We compare over 1,700 products from over 200 insurance companies in about 90 seconds. Nothing like this has ever been built in the U.S.

SUB: You just announced that you’ve raised $3 million in new Seed funding. Why was this a particularly good time to raise funding?

Lyons: We’re growing fast. TheZebra.com is a platform that drivers have needed for a long time, and we’re scaling to accommodate the consumer demand. Simon Nixon, founder of Moneysupermarket.com, the UK’s largest insurance comparison site, recently joined our investor group, bringing a whole new level of value and experience specific to online insurance comparison.

SUB: How do you plan to use the funds?

Lyons: We plan to use the funds to grow our team and ramp up marketing efforts.

SUB: What was the inspiration behind the idea for The Zebra? Was there an ‘aha’ moment, or was the idea more gradual in developing?

Lyons: Like many companies that set out to solve a problem, The Zebra was started from a place of frustration. Until TheZebra.com, there wasn’t an unbiased source where insurance shoppers could go to quickly compare car insurance and buy it in the same place. In other markets, the UK for example, around 80 percent of auto insurance is purchased through comparison sites. We think every person should have the power to make smart decisions.

SUB: Why do you think the insurance industry in the U.S. has been so slow in adopting a comparison model like yours? Is insurance just inherently slow to change like many older, well-established industries, or are there some specific structural issues that tend to discourage innovation?

Lyons: It’s the perfect storm. The insurance industry is made up of old, slow-moving, massive organizations, coupled with an ironic risk-adverse mindset. It’s a formula sure to slow down innovation.

Additionally, I think there’s a few issues specific to the U.S. market. Until TheZebra.com, there has never been a place where consumers could compare car insurance companies cross distribution channel, cross market segment. Without going into too much detail, car insurance in the U.S. is distributed through either the ‘captive,’ ‘independent,’ or ‘direct’ channel. Other sites only compare a handful of companies in the independent channel, but leave out direct writers like GEICO, and captive writers like State Farm or Allstate. That’s not what people want. In other markets around the world, where over 80 percent of car insurance is bought through comparison sites, users can compare hundreds of companies. In order to really penetrate the U.S. market, the product needs to give consumers what they want—a comparison with all the brands they’re familiar with regardless of that company’s distribution strategy. TheZebra.com is the first site to compare all of these brands, combining all three channels into one simple platform.

SUB: What were the first steps you took in establishing the company?

Lyons: The Zebra was accepted into an accelerator program in Pittsburgh, Pennsylvania, called AlphaLab, and went to work from there. Programs like AlphaLab, Y Combinator, and Techstars are really helping entrepreneurs understand what they don’t teach in MBA classes—how to turn an idea into a reality.

SUB: How did you come up with the name? What is the story or meaning behind it?

Lyons: The Zebra represents disruption through simplicity. A zebra’s stripes actually disrupt light patterns that disease-spreading flies use to find food and water. We view difficult processes and antiquated models as ‘horseflies’ and fight against that. Insurance should be simple—black-and-white.

SUB: Do you have plans to seek additional outside funding in the near future?

Lyons: We’ll likely open up a Series A financing at some point in the near future. For us, it’s always been more about getting the right folks around the table. We’re not in this for a quick flip. The Zebra was started to help consumers and simplify car insurance. We’ll be working on that until it’s done.

SUB: What have the most significant challenges been so far to building the company?

Lyons: Saying no. There’s a plethora of opportunities left-and-right—all of which are exciting. Be it partnerships, product features, or something else, we’ve been able to accomplish what we have by staying laser-focused.

SUB: How do you generate revenue or plan to generate revenue?

Lyons: We are a licensed insurance agency in all 50 states, so we make money when a user purchases their policy through TheZebra.com from the carriers we partner with. We don’t ask for any personally identifiable information during the comparison process so that users feel comfortable being honest, which is key for a valuable comparison. Once a user is ready to make a decision and buy, we help facilitate that transaction; and because they bought through TheZebra.com, we’re able to help our customers manage their insurance free for the lifetime of their policy.

SUB: What are your goals for The Zebra over the next year or so?

Lyons: Simplify insurance so people can focus on more important aspects of life. I can’t get into too many specifics right now, but 2014 is going to be a fun year. We’ve built an incredible product that will help millions of people. Over the next 12 months we plan to tell the world and grow awareness.