![]() A Q&A with FlexMinder founder and CEO Lowell Ricklefs. The Seattle-based startup, which offers Software-as-a-Service that allows administrators and patients to more efficiently manage flexible spending and health reimbursement accounts, announced in late March that it has raised $1.2 million in additional Series A funding from Rudy Gadre, Walt Winshall, and WRF Capital. It was founded in 2011 by Ricklefs, CTO Deepak Kumar, and Will Miceli, and participated in the TechStars Seattle accelerator that same year. The team has secured a total of just more than $2.7 million in funding to this point.

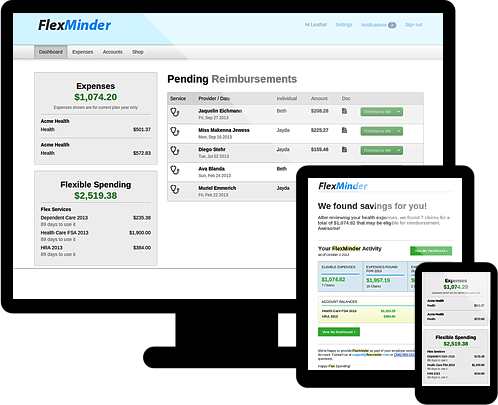

A Q&A with FlexMinder founder and CEO Lowell Ricklefs. The Seattle-based startup, which offers Software-as-a-Service that allows administrators and patients to more efficiently manage flexible spending and health reimbursement accounts, announced in late March that it has raised $1.2 million in additional Series A funding from Rudy Gadre, Walt Winshall, and WRF Capital. It was founded in 2011 by Ricklefs, CTO Deepak Kumar, and Will Miceli, and participated in the TechStars Seattle accelerator that same year. The team has secured a total of just more than $2.7 million in funding to this point.

SUB: Please describe FlexMinder and your primary innovation.

Ricklefs: FlexMinder is a simple but powerful FSA and HRA tool that unlocks insurance claim data on behalf of the participant. We make it easy for the participant to get reimbursed, and view their up-to-date medical expenses and account balances—no messy paperwork and huge time commitment. Our goal is to simplify life.

SUB: Who are your target markets and users?

Ricklefs: We partner with third-party administrators (TPAs)—the benefit management experts that work with HR departments to administer a variety of benefits, including FSA and HRA accounts. By empowering TPAs with the technology to more efficiently serve their customers, FlexMinder saves them money and saves the day for the end user, the participant. Participants can feel no fear when they sign up for tax-advantaged benefits like FSAs.

SUB: Who do you consider to be your competition, and what differentiates FlexMinder from the competition?

Ricklefs: There are a variety of indirect competitors in the form of technology companies and consultancies focused on providing solutions to drive transparency around consumer medical expenses and insurance carrier data. However, FlexMinder is unique in our ability to link insurance carrier data with consumer direct health plans like FSAs and HRAs and present medical expenses in an easily digestible way.

SUB: You just announced that you’ve raised $1.2 million in a new round of Series A funding. Why was this a particularly good time to raise more outside funding?

Ricklefs: FlexMinder recently secured a large contract with a technology partner, and this money will allow us to quickly scale to support a potentially very lucrative partnership. We have already increased our development, sales and support efforts in order to ensure successful rollout of this enhanced technology.

SUB: How do you plan to use the funds, and do you have plans to seek additional outside funding in the near future?

Ricklefs: We will use the funds to continue to develop and evolve the product, build carrier connections and a user interface that far exceeds what is available in the marketplace.

SUB: What was the inspiration behind the idea for FlexMinder? Was there an ‘aha’ moment, or was the idea more gradual in developing?

Ricklefs: The idea for FlexMinder was born out of real life frustration. One of the FlexMinder founders found himself shuffling through hundreds of receipts in a shoebox and compiling claim paperwork so his father could receive his end-of-the-year FSA reimbursement. Needless to say, this was not an ideal way to spend Christmas vacation. An experienced process consultant, he found himself thinking there was a way to make this easier, and technology was the answer.

SUB: What were the first steps you took in establishing the company?

Ricklefs: Interviewing and just talking to thousands of people provided key insights into whether this was a viable product and whether this could be a company that could make money. However, the TechStars accelerator program is what really provided FlexMinder the resources and mentorship to truly launch the company.

SUB: How did you come up with the name? What is the story or meaning behind it?

Ricklefs: We wanted to create a name that could really say what we do. ‘FlexMinder’ fit that requirement as our technology ‘monitors’ or ‘minds’ your FSA account. We track medical expenses and prepare claims on behalf of the participant. We think the name is a great tool for telling that story.

SUB: What have the most significant challenges been so far to building the company?

Ricklefs: Integrating our technology into long-established systems and processes that move huge amounts of data and care for millions of participants on a daily basis can be most challenging.

However, our partnership with a leading industry technology vendor has eased that transition and allows for little disruption in the process, but brings huge value to our clients.

SUB: How do you generate revenue or plan to generate revenue?

Ricklefs: Our revenue model is very simple and affordable for our clients. We use a monthly subscription model based on number of participants using the FlexMinder platform. This flat monthly fee is replicated throughout the industry, making it easy for our clients to sign on.

SUB: What are your goals for FlexMinder over the next year or so?

Ricklefs: Kick ass! This year is all about growth and onboarding new customers. We have proved our technology works, and consumers love it. Now we continue to build our credibility through great customer service and a top-notch product.