A Q&A with Finom co-founder and co-CEO Aziz Lalljee. The Chicago-based startup, which offers a platform that matches investors with financial advisers based on personal preferences, announced its launch out of beta in late May. It was founded in 2011 by Lalljee and David Gomel, and has been bootstrapped to this point. The service is currently available in the Chicago metro market.

A Q&A with Finom co-founder and co-CEO Aziz Lalljee. The Chicago-based startup, which offers a platform that matches investors with financial advisers based on personal preferences, announced its launch out of beta in late May. It was founded in 2011 by Lalljee and David Gomel, and has been bootstrapped to this point. The service is currently available in the Chicago metro market.

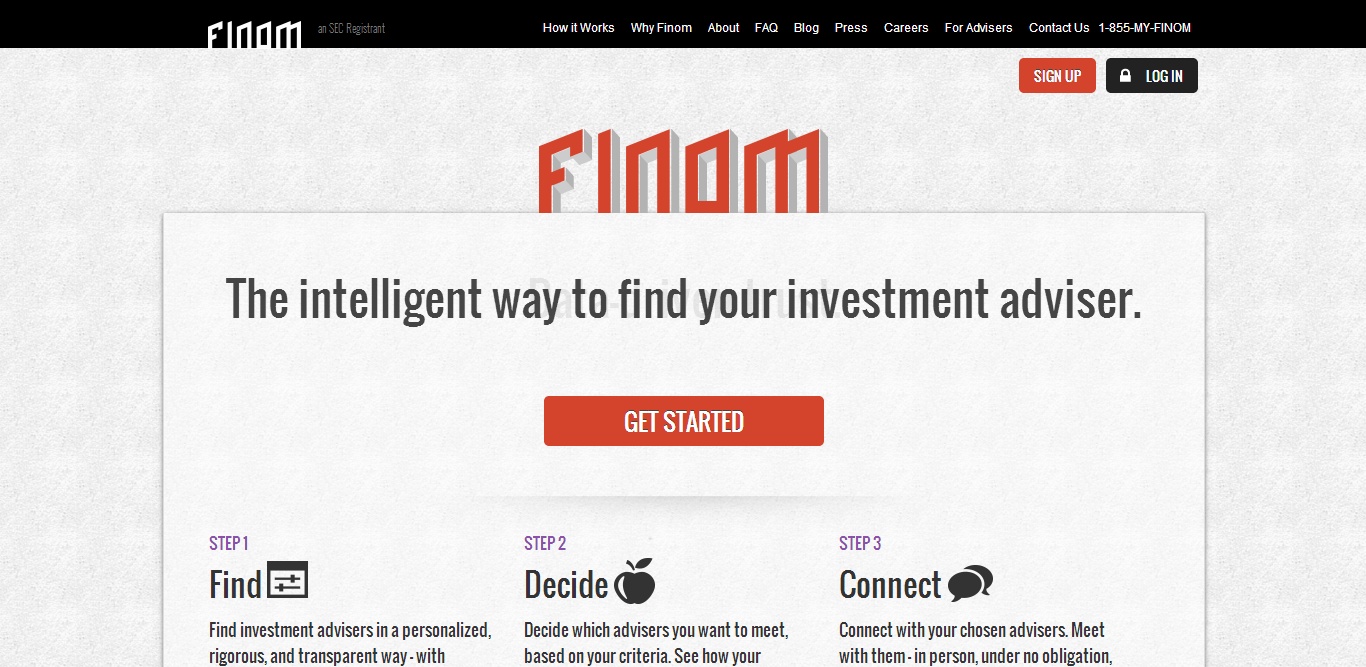

SUB: Please describe Finom and your primary innovation.

Lalljee: Finom is a website that helps people find the best money managers for their specific investment goals and adviser preferences. We are the only platform for mass-affluent and high net worth individuals and small institutions to find investment advisers in an objective and personalized manner.

We are the first company to have historical performance and practice data on investment advisers and the first to use this data to empower investors. With Finom, investors can ensure they are making the best decisions for their retirements.

SUB: Who are your target markets and users?

Lalljee: We are targeting 25-to-55 year-olds with $100,000-to-$5 million in investible assets. This includes people who are either dissatisfied with their current adviser or are searching for an adviser for the first time.

We are especially focused on finding the right adviser for folks going through key life transitions, such as a divorce, sale of a family business, inheritance, retirement, kids moving to college, birth of a new baby, etc. These are all times when the right investment adviser can add immense value to people’s lives.

SUB: Who do you consider to be your competition, and what differentiates Finom from the competition?

Lalljee: Word-of-mouth is really the current default; think recommendations from friends-and-family, or from lawyers and accountants. But none of these are informed, objective or personalized to the specific individual’s investment goals and interpersonal preferences.

At Finom, we learn both where you are in your financial life and what you want from your adviser, and then show you how your investments would have fared, after fees, under each suggested adviser’s management. We empower you to meet the best advisers—in person, at no cost, and under no obligation—so you can decide for yourself if you like and trust them, and want to hire them.

SUB: You just launched to the public out of beta. Why was this the right time to launch?

Lalljee: We worked through the excellent feedback we received from both investors and advisers through our beta. We streamlined and simplified the process for investors to review advisers and schedule meetings, without compromising any of our analytics or functionality. After two years in development and testing, it was finally time.

SUB: Have you raised outside funding to this point?

Lalljee: We’re bootstrapped so far—thank you to our very patient and supportive wives! It was really important to us to develop the platform and demonstrate traction in Chicago on our own dime before raising outside capital. We should be in a good spot to raise a round later this summer.

SUB: What was the inspiration behind the idea for Finom? Was there an ‘aha’ moment, or was the idea more gradual in developing?

Lalljee: To start with, it was personal—both our families had terrible experiences with investment advisers that had been highly recommended through our networks. Poor investment management and poor communication by these advisers left us paralyzed, unsure where else to look or who to trust. As we dug deeper, we found that this industry has fundamentally been untouched by the explosion of data available in almost every other industry.

It’s absurd that you can find every detail about the fit of a shoe before purchase, and yet you are really flying blind when it comes to one of the most important life decisions you can make—who to trust with planning and investing for your retirement.

Also, it turns out that the best people and firms to plan and invest for your retirement are not necessarily the best marketers. The financial advisory industry suffers from a strong gravitation pull towards the biggest firms with the biggest marketing budgets and brands. We want to level the playing field and force advisers to stand on their actual investment management records. On multiple fronts, this is an idea whose time has come.

SUB: What were the first steps you took in establishing the company?

Lalljee: Before venturing into a highly-regulated, old-fashioned, and brand-centric industry, we spent a year trying to ‘kill our darling.’ We really wanted to understand why a firm like Finom did not exist. We spoke to hundreds of people—industry insiders, outsiders, observers, and users.

We seriously considered every single reason why our idea would not work. We became our own worst critics. Only when Finom remained conceptually intact through that crucible did we invest real time and money into this company.

SUB: How did you come up with the name? What is the story or meaning behind it?

Lalljee: ‘Finom’ is a portmanteau of ‘finance’ and ‘phenomenal.’ We wanted a name that was short, meaningful and memorable. People seem to like it so far.

SUB: What have the most significant challenges been so far to building the company?

Lalljee: The hardest part was overcoming deep skepticism in this industry about the value of data-driven decision making for individual and small institutional investors.

We were initially told that no adviser would share their holdings information with us. We were then told that even if we had the data, we could not use it to power analytics that are meaningful to unique investors with specific investment goals and adviser preferences. Finally, we were told that investors would not care about risk-adjusted, after-fee performance records of advisers. We’ve disproved the skeptics at each step, which has been both challenging and rewarding.

SUB: How do you generate revenue or plan to generate revenue?

Lalljee: If you decide to hire an investment adviser that you find through us, we charge that adviser a solicitation fee. No part of that fee can be passed on to you. Finom is completely free to investors, and our fees are uniform across advisers so we never have any perverse incentives.

SUB: What are your goals for Finom over the next year or so?

Lalljee: We plan to build on our initial success in Chicago by drawing more investors to the website and facilitating more adviser-investor meetings.

Later this summer, we plan to raise our first round of outside capital, which will allow us to begin expanding into other geographies, sign on more advisers, build out our team, and create a more scalable operation.