A Q&A with Advice Wallet co-founder Stas Matvienko. The Kiev, Ukraine-based startup, which offers a combined payments and loyalty app for consumers called Settle, announced the closing of a $1.5 million venture funding round at the start of August from Russian VC Life.SREDA. It was founded in 2012 by Matvienko, Anna Polishchuk, Pavel Matvienko, and Andrily Khavryuchenko, and this was its first round of outside funding.

A Q&A with Advice Wallet co-founder Stas Matvienko. The Kiev, Ukraine-based startup, which offers a combined payments and loyalty app for consumers called Settle, announced the closing of a $1.5 million venture funding round at the start of August from Russian VC Life.SREDA. It was founded in 2012 by Matvienko, Anna Polishchuk, Pavel Matvienko, and Andrily Khavryuchenko, and this was its first round of outside funding.

SUB: Please describe Settle and your primary innovation.

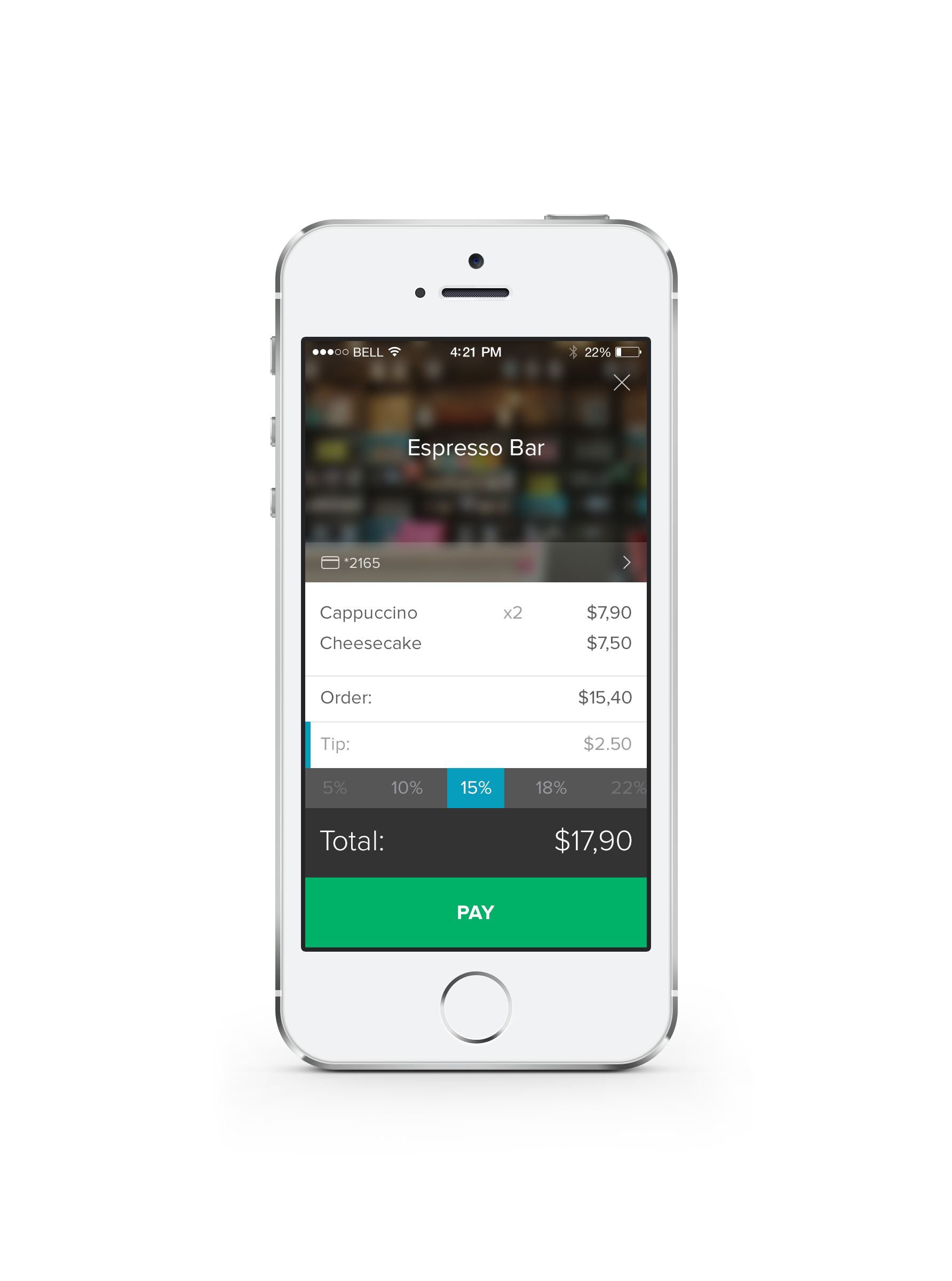

Matvienko: Combining mobile payments and a loyalty scheme in one app, Settle makes it possible to both order and pay through a smartphone. The app displays the menu and allows clients to make pre-orders, pay, carry out P2P transactions and get personalized offers.

Merchants receive a free Settle tablet and an accompanying app that enables them to resolve a customer’s bill, view guests’ profiles and monitor their activity. The back office system shows detailed analytics in real-time and offers tools for communication with customers.

The technology provides significant benefits to merchants—faster turnarounds, higher tips for servers, and more targeted marketing to consumers based on their paying behavior and social graph.

SUB: Who are your target markets and users?

SUB: Who are your target markets and users?

Matvienko: Our target markets are HoReCa, retail, taxi and fuel stations. We see a great potential in using the Settle app at these sectors.

SUB: Who do you consider to be your competition, and what differentiates Settle from the competition?

Matvienko: In Ukraine and Eastern Europe we don’t have any competitors. Settle is a first mobile application providing such kind of mobile payments in this region. There are a few competitors in the USA, Western Europe and Canada. Among them are Spleat, FlyPay, MyCheck, Cover, Tab, Dash. However, they provide mobile payments only, while Settle will let users to pay for order, to make an order in a menu on their phone, split the bill with their friends, make cash transfers to their friends, and finally receive bonuses for loyalty.

SUB: You just announced that you’ve raised $1.5 million in Seed funding. Why was this a particularly good time to raise funding?

Matvienko: There is no good or bad time for raising funding. Every project needs sufficient funds to be able to operate on the market. Yes, maybe it is not the easiest time for business, but we love what we do and want to deliver some value to our users and customers, notwithstanding external problems.

We were in process of attracting investment for the project Advice Wallet and had talks with Life.SREDA. The expertise and professionalism of this fund impressed us a lot. Life.SREDA is a fund with good investment profile. When we were in a process of talks, we decided to create a mobile payment service and develop both startups at the same time, and got the fund’s support.

SUB: How do you plan to use the funds, and do you have plans to seek additional outside funding in the near future?

Matvienko: The larger part of the money will be used for our new project Settle. We plan to introduce new features in the nearest future. Therefore, customers will be able to make an order in a menu on their phone, split the bill with their friends, make cash transfers to their friends, and finally receive bonuses for loyalty. Also, we plan an expansion into Russia and Poland. Besides, we plan to develop further the Advice Wallet mobile loyalty program. Of course, we are planning to seek additional investments for the expansion and growth of Settle in (the) future.

SUB: What was the inspiration behind the idea for Settle? Was there an ‘aha’ moment, or was the idea more gradual in developing?

Matvienko: The idea to create a mobile payment project was born six months ago. We know about the problem with payments at restaurants. For example, when you are waiting for the check and change, if you can’t leave a tip when you pay with your credit card, and you don’t want to give the card to (the) waiter because it is not secure.

We were in process of attracting investment for the project Advice Wallet and had talks with Life.SREDA. But Advice Wallet is a mobile loyalty program, not a fintech startup, so we did not meet the needs of their investment focus. At one of our mutual meetings, we discussed features to improve dining and payment experience with Vladislav Solodkiy, managing partner and CEO at Life.SREDA. We came up with the idea to create a mobile app bridging payment service and loyalty program. So, we decided to start working in this direction and create a mobile payment service—Settle.

SUB: What were the first steps you took in establishing the company?

Matvienko: We have an Advice Wallet Inc., so we just created the subsidiary for Settle.

SUB: How did you come up with the name? What is the story or meaning behind it?

Matvienko: Searching the name lasted longer than the development of the first prototype. We tried many different types of naming, but decided that it should be one word name, and associated with the specifics of the product. So, we chose the name ‘Settle’—to pay, to pay off. We are confident that with this name, we will build a strong and recognizable brand.

SUB: What have the most significant challenges been so far to building the company?

Matvienko: Significant challenges always appear if you create something new, especially building (a) company. We were so excited about Settle so we could develop a working prototype just in two weeks and started an integration with the biggest and the most innovative bank in Ukraine. So, any trouble we faced during development became a useful experience for every member of our team.

SUB: How do you generate revenue or plan to generate revenue?

Matvienko: The service charges from merchants a commission on every bill. However, subscription is free. For users our service is free. Our revenue is a commission from every bill which will be processed via Settle.

SUB: What are your goals for Settle over the next year or so?

Matvienko: We want to add the feature of orders and pre-orders. Also in the next versions of Settle app, customers can split the bill, make cash transfers to their friends, and receive bonuses for loyalty. After a successful launch in Kiev, we plan an expansion into Russia and Poland markets.

Settle is planning to use the iBeacon technology for automatic check-ins, too. The beacons, installed in restaurants, automatically detect a customer with the app and send them personalized offers.