A Q&A with DemoChimp co-founder and CEO Garin Hess. The American Fork, Utah-based startup, which offers an intelligent personalized demo platform for salespeople, announced in mid-April that it has raised $2.8 million in Seed funding. Investors include Peak Ventures, Albion Financial, Seed Equity, Select Venture Partners, Paul Ahlstrom, Scott Frazier and Greg Schenk. It was founded in 2013 by Hess, Matt Behrend, and Scott Rafferty, and previously secured a $100,000 convertible note back in October of last year.

SUB: Please describe DemoChimp and your primary innovation.

Hess: More than five people are involved in most B2B purchasing decisions. Traditional methods of selling into a champion and hoping they can sell the rest of the buying committee stretch out the sales cycle and increase the risk that the company may not make a decision at all. DemoChimp is Software as a Service (SaaS) that solves the buying committee problem by intelligently automating personalized demos to drive consensus and accelerate B2B sales. We significantly increase salespeople’s productivity because we scale the demo process, which is very labor-intensive.

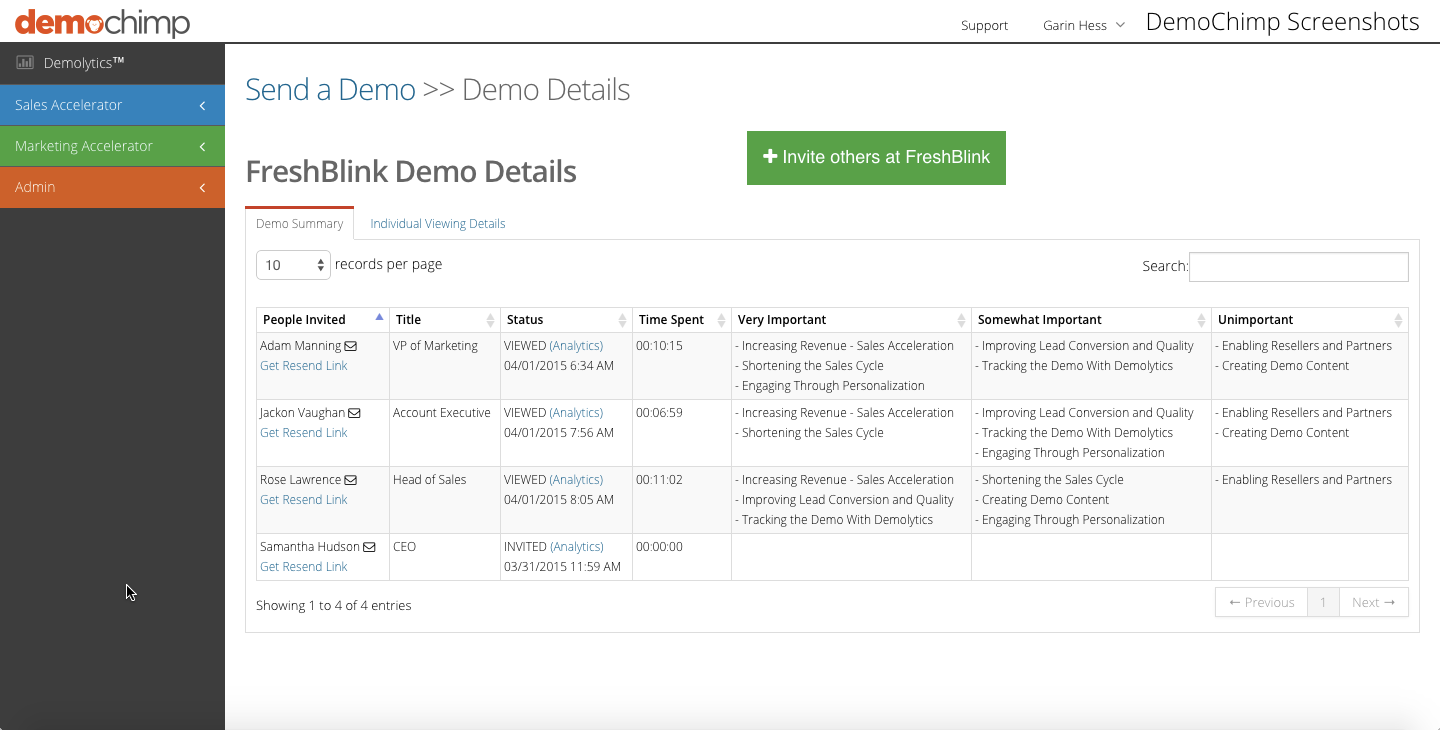

Our primary innovation within DemoChimp is our demo analytics, or ‘Demolytics.’ It’s a dashboard that tracks who watched the salesperson’s demo, what each buyer watched and who they shared it with in their organization. When someone interacts with a DemoChimp demo, 61 percent of the time they will share it with other stakeholders. Demolytics helps salespeople discover and engage the entire buying committee and focus their sales call messages on those product benefits that are of greatest interest to each buyer and to the larger buying committee. Aligning sales messages with buyer needs increases sales close rates and engages stakeholders early in the sales process to shorten sales cycles.

SUB: Who are your target markets and users?

Hess: DemoChimp is designed for B2B sales executives, sales teams and buying committees who are looking for new ways to increase sales with proven ROI. We started with SMBs and mid-market companies, but have recently seen some great traction with enterprises across software, financial services software, and healthcare software.

SUB: Who do you consider to be your competition, and what differentiates DemoChimp from the competition?

Hess: Today, we don’t run into direct competition in our sales conversations. We live under the broader umbrella of sales acceleration or sales enablement, which is obviously growing to be a very expansive market.

Intelligent demo automation is a new subcategory we’re creating within the sales acceleration market where interactive technology automates demos in a way to personalize to each person’s interest. Intelligent demo automation done right like DemoChimp helps sales people shorten their sales cycles and increase close rates.

Corporate training went through a similar transformation over the last 15 years and interactive e-learning technology has gained widespread adoption to automate what used to be a very labor-intensive effort. Demo automation is going to follow a similar path, but more rapidly.

SUB: You just announced that you’ve raised $2.8 million in Seed funding. Why was this a particularly good time to raise funding?

Hess: The funding is from institutional venture capital firms and Angel investors led by Peak Ventures, along with Albion Financial, Seed Equity, Paul Ahlstrom, Select Venture Partners, Scott Frazier, and Greg Shank.

Seed rounds range from a couple hundred thousand to a couple million. A $2.8 million Seed round is somewhat unusual and would’ve been considered a Series A round five years ago. The fact that we’ve raised a $2.8 million Seed round that institutional investors led makes a strong statement that DemoChimp is onto a big opportunity.

SUB: How do you plan to use the funds, and do you have plans to seek additional outside funding in the near future?

Hess: DemoChimp will use the funds to increase the size and velocity of the marketplace conversation about the consensus-driven sale and to grow the new category of intelligent demo automation, along with accelerating our customer acquisition and product development efforts.

We expect to close Series A by this summer. Our Series A investment will allow us to significantly accelerate our customer acquisition growth, which will help us expand even further into enterprise deals.

SUB: What was the inspiration behind the idea for DemoChimp? Was there an ‘aha’ moment, or was the idea more gradual in developing?

Hess: DemoChimp has three co-founders: Matt Behrend, our chief sales officer, Scott Rafferty, our chief business development officer (CBDO), and me. In my last startup, Rapid Intake, we applied interactive technology to automate corporate training. We offered a rapid e-learning development tool that allowed teams to collaboratively build e-learning content in the cloud and for mobile.

Selling B2B, we were constantly struggling with this challenge of selling into the buying panel and not having enough people to do all of the demos we needed to effectively address the buying panels for every company. So, we were constantly making tradeoffs. When we exited and I left the company that bought Rapid Intake, I wanted to find out if selling to the buying committee was a big problem that was applicable to other companies.

I talked to 30 different SaaS companies, which was our target entry market, to find out if they thought selling to the buying panel was an important problem, too. Through these validation conversations, I found out that 77 percent of them rated this problem as being severe or extreme, so I knew we were on to something that was bigger than just my problem at Rapid Intake. That’s where I got the idea.

SUB: What were the first steps you took in establishing the company?

Hess: In February of 2013, I started sketching out the idea for DemoChimp—literally with paper and pencil—working out of the basement of my house. I bootstrapped the company for the first fourteen months or so, using the proceeds from the sale of my first company. I hired my nephew to help me work through the initial validation phase of the process and then brought on Matt and Scott.

Having validated the concept and tuned our product-market fit, I began raising capital to help us accelerate the development of our product and go-to-market strategy. We first started selling DemoChimp in February, 2014, and now have over 100 customers.

SUB: How did you come up with the name? What is the story or meaning behind it?

Hess: In one of my early concept validation interviews, a sales leader I was having lunch with told me how much his team loved our product. One of his sales reps commented on how tired he was of being the ‘demo chimp.’ That gave me the idea for our company name. It aptly describes how, using technology, we can automate something that isn’t the best use of people’s time or talents.

SUB: What have the most significant challenges been so far to building the company?

Hess: We’re already a good company, and we have a bright future ahead of us. We just need to continue to execute to capture the market opportunity.

SUB: How do you generate revenue or plan to generate revenue?

Hess: We have an annual software subscription based on user licensing. A user usually represents a salesperson. We’re currently getting paid pilots inside one division of an enterprise before expanding into other divisions. One example is a current enterprise customer who has 80 reps in one division using our software and is looking to expand into other divisions.

SUB: What are your goals for DemoChimp over the next year or so?

Hess: We believe we have a huge opportunity for growth ahead of us. The problem we’re solving with DemoChimp as it is today is significant. We’ve already proven that DemoChimp solves the B2B buying panel problems for our customers, with increased close rates and decreased sales cycles. We believe that, based on this same product philosophy, model, and platform, there are other products we are building that will accelerate B2B sales, but will involve different points in the sales process.