Ninety percent of startups fail, we are often told. To bring some more informative statistics to bear on the issue, it turns out that 82% of these businesses fail because of cashflow problems, while the most successful startups are in the fields of accounting, tax preparation, bookkeeping and payroll services. Which suggests startup’s financial difficulties are at least as much about managing finances as they are about raising them.

Canadian fintech company PayPie has been setup to address this by using blockchain security to change the way companies perform their accounting, thus enabling live financial audits, quicker credit approvals, and improved overall credit scoring processes.

The biggest advantage of using blockchain is that companies can write their transactions directly into a joint register to create a system of accounting records which are immediately comparable. The data are then fed into an algorithm which can produce an objective score of a business’ credit health to be used by interested parties.

Nick Chandi

Co-Founder of PayPie

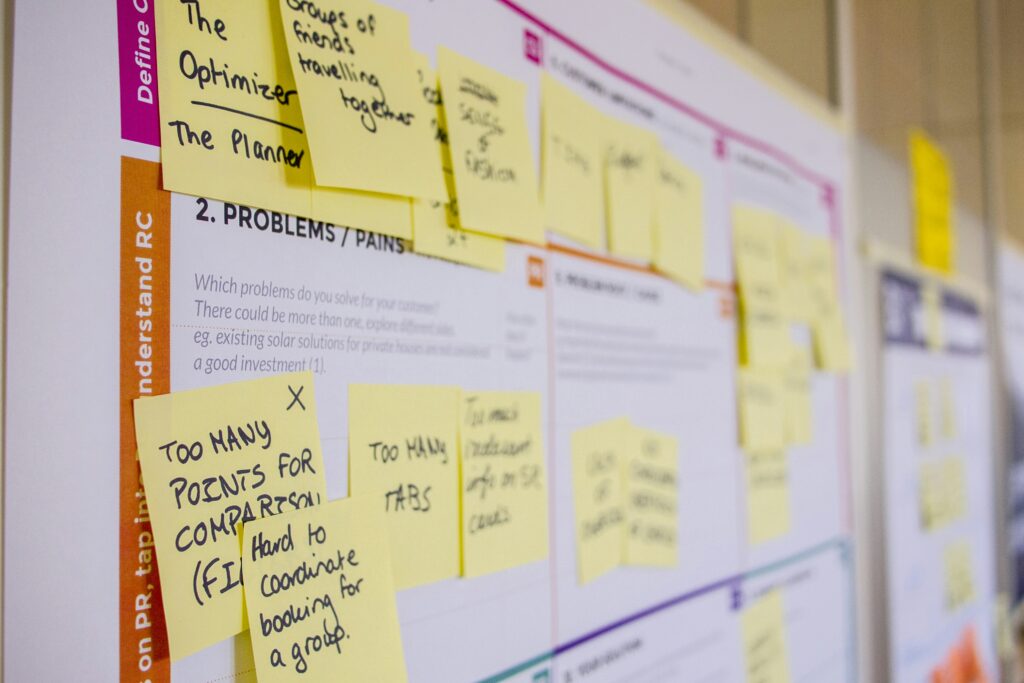

“Often a company’s financial situation is inaccurate, due to a lack of information and the fact that this information is usually outdated”, said PayPie CEO, serial entrepreneur, and member of the Forbes Technology Council, Nick Chandi. “We can avoid these issues and make the system fairer both for the businesses themselves, as well as those who wish to access the financial information.”

Funding a business with inaccurate information is not just bad for the investors but it’s also unfair on the business, since performance will be based on business health. Coupled with this the feeling in the market is that a skeptical eye should be applied to company finances, they’re probably not wholly accurate but there hasn’t previously been a preferable option.

The idea of a more transparent system of scoring a company means that the score itself can be trusted because everyone is operating on the same understanding.

“Replacing conventional methods used by accounting firms would not just increase the quality of the end result, it should also make the whole process more efficient from start to finish and save these firms a lot of money,” added Chandi.