Written by Kyle Stoner, the CEO and co-founder of Abode, a one-stop-shop for real estate which helps both buyers and sellers navigate the process from start to finish.

In a 2011 Wall Street Journal essay, Marc Andreessen famously proclaimed that “software is eating the world.” Clearly, one only need to look at the transformation of industries that once seemed unshakable to recognize the weight of this observation. Twenty years ago it seemed impossible to displace the taxi industry; enter Uber. Even services with a high barrier to entry like financial investments, which traditionally necessitated the involvement of high-paid advisors and brokers, have been transformed with applications like RobinHood.

So, how has the traditional real estate market remained largely unchanged while other industries have succumbed to technological renovation? Surely, software may be “eating the world”, but it has taken its time to bite into the real estate market.

The problem has been that real estate is a legacy industry that is supported by big dollars and held captive by powerful cartel forces. Million-dollar sales can come with a commission of more than $30,000 for the agent. This is income that realtors (naturally) want to protect. Moreover, lobbying groups have made it incredibly difficult for technology to enter the space and disrupt these entrenched businesses.

Yes, I know what you’re thinking: there has been tremendous innovation in home browsing, where easy online search is the norm. This is true; however, the majority of realty transactions remain under lock and key of the industry, who keep processes manual and run through intermediaries — resulting in very high commissions for retail consumers. Thus, while other industries have been transformed by software and the startups that create it, the real estate industry has trudged on, maintaining the structure and processes of yesteryear.

That is all about to change.

Software has eaten the world

It is no secret that the modern, digital world and the applications that come with it are transforming traditional industries. Twenty years ago it seemed impossible to displace the taxi industry, and yet today we use “Uber” as a verb for transport. Such software-driven solutions eliminate intermediaries to drop costs and pass those savings onto the user, all the while improving customer service.

These services bring affordability and clean user experience to a legacy infrastructure. Take travel websites for example: When you search for a flight on Expedia, you’re actually utilizing the same backend travel booking infrastructure that travel agents used for decades. Therefore, you don’t need to reinvent everything to bring dramatic improvements to the process.

Getting power and keeping it

Real estate is a laggard. It’s one of the last industries to be eaten by software and for good reason: money and power. First, there is just so much capital tied up in the industry that change is laborious. U.S. residential real estate is a $1.6 trillion business.

Second, lobby groups. The real estate industry (The National Association of Realtors) makes up some of the biggest lobbying groups in the United States and they are prepared to fight for their position. They have made it difficult for technology to enter the space and disrupt their profitable business. The browsing element of home buying may have migrated online (and even that was a battle), but the majority of realty processes remain with the industry.

Finding a house online is easy but going through the process of buying or selling is not. This remains run by the real estate cartels who keep processes manual and run through intermediaries. In the end, the customer continues to pay very high commissions rather than direct buying or selling.

The truth is that the real estate industry has been better than most at keeping processes under their control – until now.

Why it matters

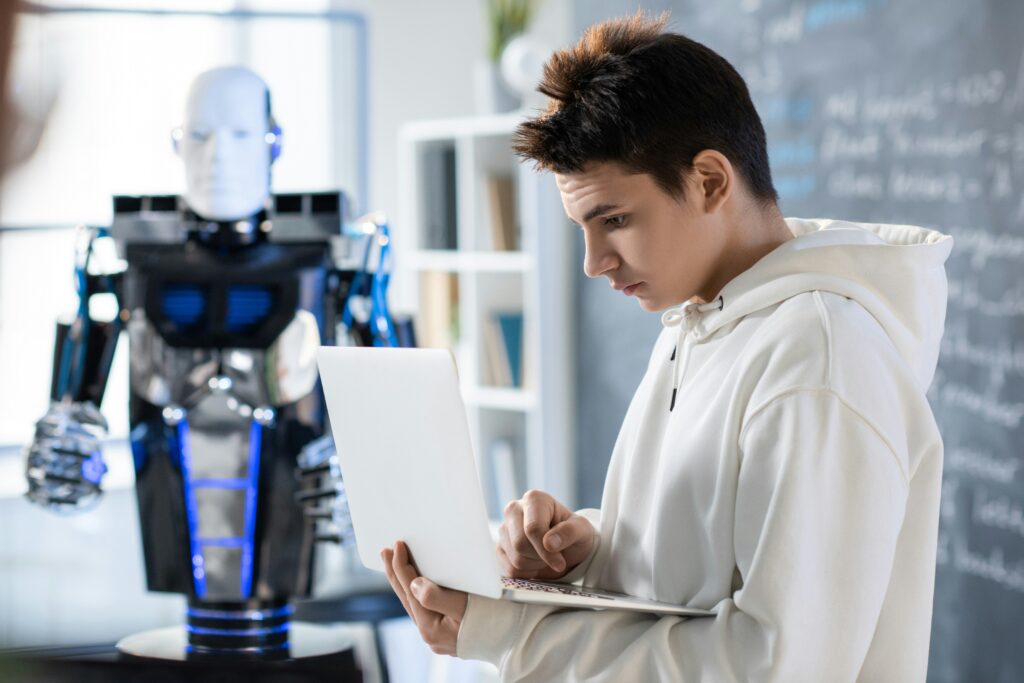

Times are changing. Just like any other industry it was a matter of time before tech took charge to turn traditional processes in the real estate industry on their head. Zillow and Compass are two examples which offer digital listings and easy access to real estate agents. The true revolution, however, will occur when data comes to the fore.

Unbiased guidance based on each customer’s budget and location will set tech applications apart from their real-life counterparts. Instead of gunning for the biggest commission or price, tech solutions will give free advice along with step-by-step guidance throughout the process.

Take for example USRealty. Digitized forms and automated listings now help consumers that prefer the DIY approach. Ten years ago this didn’t exist. In the past, it was very difficult to list any home on the MLS without an agent. This made it difficult for consumers to get their home listed in all the important places. The owner could list it themselves, but that’s different from having it where all the buyers can find it.

The problem is not agents – in fact, some people still want to be guided through the biggest transaction of their life by humans and that is completely understandable. The problem is the unnecessary red tape the industry has inflicted upon the process.

Most importantly, this is an industry that matters. If you think about the milestones of life, buying a house is often considered one of the most consequential. It is emotional and usually signifies an important milestone. Maybe the homebuyer has a new job or a new addition to the family. In fact, many people buy a home based on the school zone in which it sits. It is an aspirational and important purchase. These are big life decisions, with the average person only making a home purchase every seven years.

The truth is that many people do not want to make this decision on their own. This is where real estate pros will continue to do important and needed work. However, the antiquated, manual way that transactions are currently undertaken will continue to evolve into something far more streamlined. Inevitably, this will force margin compression for intermediaries as has happened in nearly every other industry. It may also free up agents to provide value in other, more efficient ways.