By Shrad Rao, Wagepoint co-founder and CEO

By Shrad Rao, Wagepoint co-founder and CEO

ELEVATOR PITCH

Wagepoint is an online payroll software built just for small businesses in the USA and Canada, backed by the world’s friendliest team. Over 500 customers have chosen to trust Wagepoint with their payroll—you should, too!

PRODUCT/SERVICE DESCRIPTION

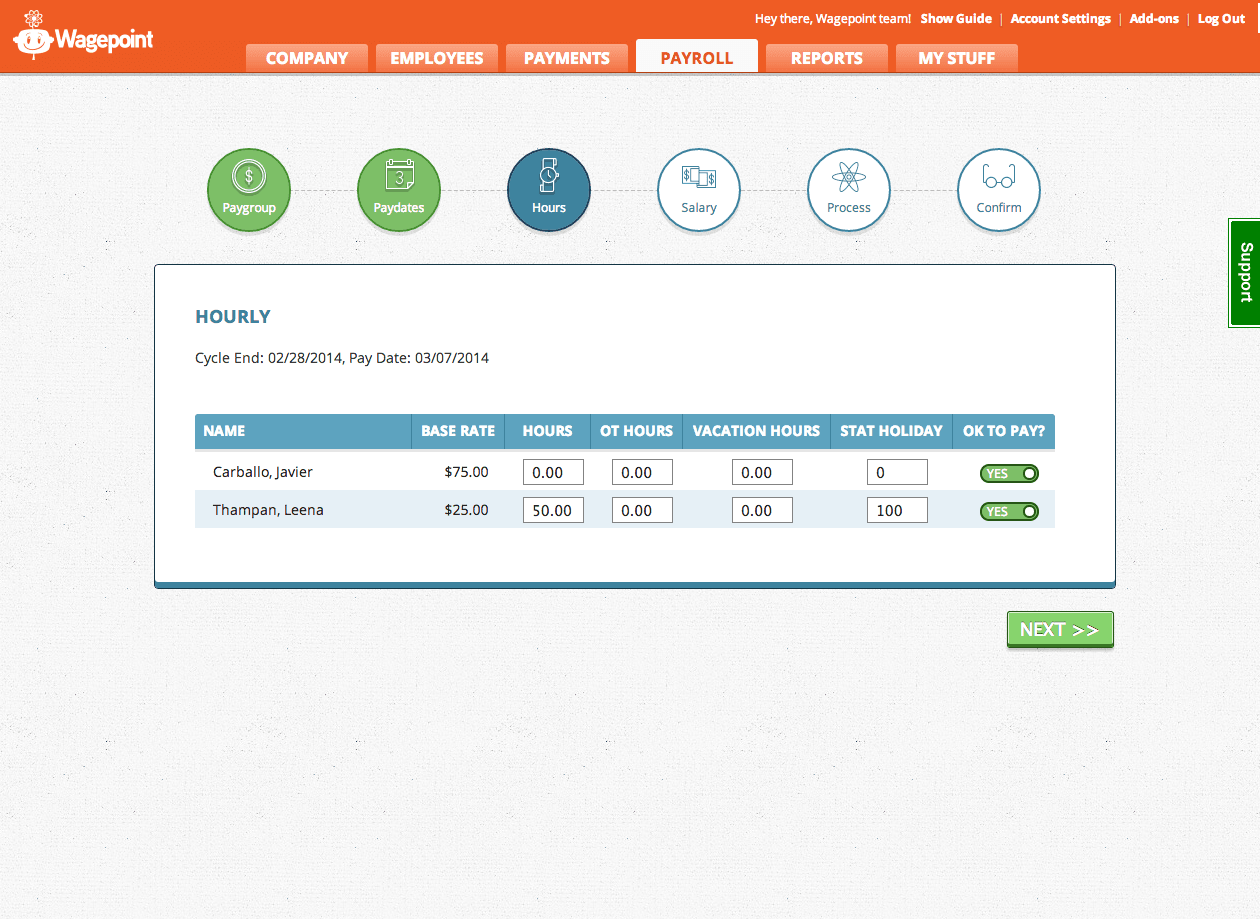

Wagepoint is simple, fast and friendly Cloud-based payroll software backed by the world’s friendliest customer service team. We help small business owners pay their employees via direct deposits and also take care of federal, state and local taxes in the United States. As a multi-country payroll solution, Wagepoint also supports all provinces across Canada.

But that’s just table stakes for us.

We want to step up the game by bringing some payroll joy into the lives of our awesome customers. At Wagepoint, customer service isn’t an afterthought—we believe that small businesses deserve to have the very best experience. There’s no reason that small businesses can’t be treated the same as enterprise clients, and we deliver on the things they value the most: Time, money, and a great relationship.

FOUNDERS’ STORY

We are three founders: Shrad Rao, CEO; Ryan Dineen, COO, and Bill Murphy, chairman of the BOD. We created Wagepoint out of our passion for helping small businesses. We got together to make the act of running payroll simple—and maybe even kind of fun—for small businesses.

When we first sat across the table from each other and discussed what was missing in the human resources space, we decided to explore payroll. We started with payroll because of all the HR technology out there, payroll software is the one you need right from day one, the moment you hire your first employee.

In our efforts to understand what was missing in the space, we spoke with hundreds of small businesses and learned exactly what they valued when it came to payroll software and services. All three of us have prior experience founding other companies and, as a result, we could relate to most to the pains of a small business owner. Just like us, these owners wanted to simplify their lives.

MARKETING/PROMOTION STRATEGY

We target small businesses in the U.S. and Canada with one-to-200 employees. We employ mostly inbound marketing strategies to attract and qualify visitors to our website. From there, potential customers can sign up for a 30-day free trial of our app and run their first few payrolls on the house to see if it is a fit for them. Set up usually takes about 30 minutes, but it is dependent on how many employees are on payroll. We also work with a number of accountants who help their clients run payroll on Wagepoint.

MARKET OPPORTUNITY

The market is dominated by large players like ADP, Paychex, Ceridian, etc., who have traditionally serviced the enterprise market with complex workflows. However, their products are often built on legacy platforms and are over featured for the needs of small business. Moreover, because of their scale and the way these companies operate, small business don’t get the customer service they need. They usually have to call in to call centers and wait on the phone for a long time to have their questions answered. To top it off, these services are generally expensive and there is a lot of nickel-and-diming that takes place after the company signs up for the service.

So, even though the space appears competitive, there are actually limited options for small businesses looking to leverage next-generation technology from a payroll perspective.

With Wagepoint, a small business can sign up and set their company and employees up within a day, most times in a matter of hours. After they approve their payroll, we take care of the direct deposits to employees and all the federal, state, and local tax reporting, so that they are never late on a payment to the government. They can also invite their employees to view their pay stubs and year-end W-2s in their own personal accounts. Our costs are simple and transparent so that small business owners know exactly what it will cost them to run payroll.

DIFFERENTIATORS

Our customer experience is completely different from traditional payroll services on two fronts—our product and our customer service.

We wanted to change the way small businesses experience payroll by building a product that was simple and fast to use, backed by incredible customer service. We asked ourselves: “Why can’t payroll software be as intuitive and easy-to-use as consumer-facing products like Facebook?” That’s the lens we use to build our product.

Our customers tell us that our service is the biggest differentiator from the competition. To paraphrase Tony Hsieh, CEO of Zappos, we are a customer service company that just happens to sell payroll software. We would approach any business we built with the same focus on customer service.

BUSINESS MODEL

Our business model is simple and transparent:

USA – $15/ base fee plus $2 per employee per pay

This includes:

– Direct deposits to employees

– Federal tax payment and reporting

– 10 state/local tax payees payment and reporting

– Additional state/local payees are charged at $2 per payee

– Year-end W-2s

– Payments to contractors

– Employees access to paystubs and year-end W-2s

– and much more…

In Canada, we offer all the same services, but to the Canadian tax agencies and our fees are $20/ base fee plus $2 per employee per pay.

CURRENT NEEDS

We are always looking for talented teammates to join us and make the world a better place for small businesses. Right now, we are looking for really great UX/front-end developer talent.

# # #

HEADQUARTERS: Waterloo, Ontario, Canada

HEADQUARTERS: Waterloo, Ontario, Canada

WEBSITE: www.wagepoint.com

FOUNDERS: Shrad Rao, Ryan Dineen, Bill Murphy

INVESTORS: Bill Murphy, Richard Landzaat, Jerry Kestenbaum

YEAR FOUNDED: 2012

ANGELLIST: angel.co/wagepoint

TWITTER: @Wagepoint

FACEBOOK: facebook.com/Wagepoint

CRUNCHBASE: crunchbase.com/organization/wagepoint

LINKEDIN: linkedin.com/company/wagepoint