By Sam Das, Wherewithal founder and CEO

By Sam Das, Wherewithal founder and CEO

ELEVATOR PITCH

Cash back savings meets online investing.

PRODUCT/SERVICE DESCRIPTION

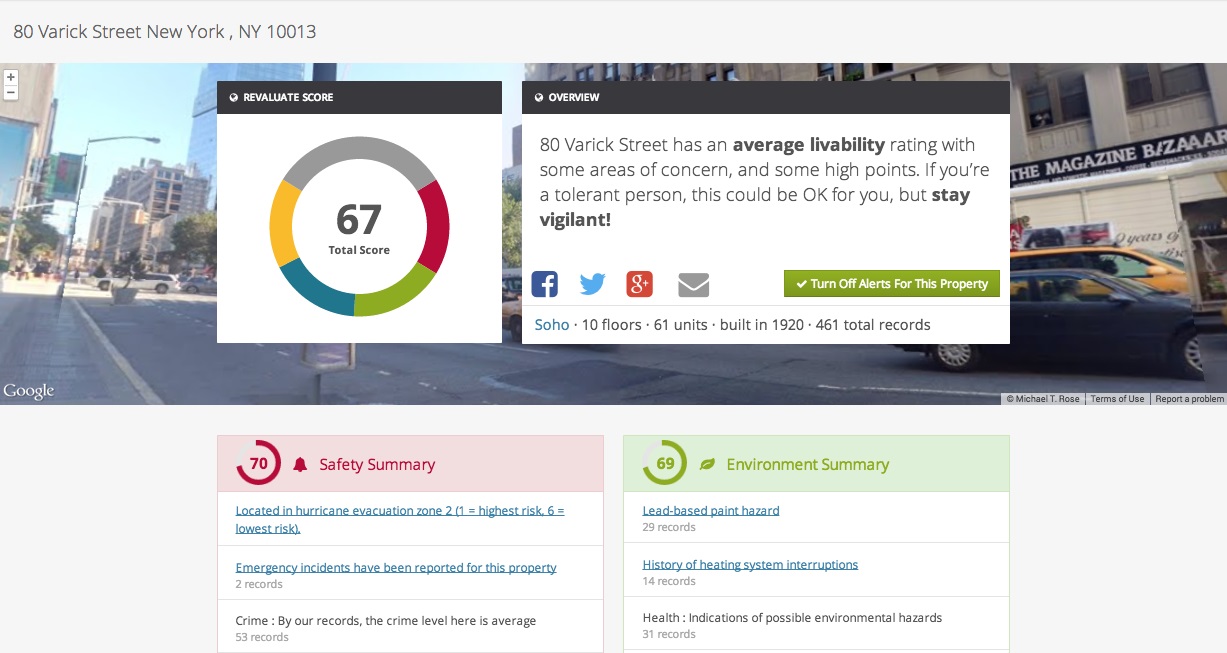

Wherewithal helps you start building your savings without ever depositing a penny. When you do your usual online shopping, you’ll earn cash back that we’ll automatically save and invest for you. With the personal savings rate for Millennials at -2 percent, Wherewithal aims to turn old spending habits into new savings habits.

FOUNDER’S STORY

Wherewithal was founded to help people reach their goals through investing and feel good about it along the way. With Wall Street, chaos seems the order of the day. Big banks and questionable ethics run rampant. Investors have been worn down by confusing products, small print and a culture that favors trading over investing. With Wherewithal, we’ve slowed things down. We’ve untangled the typical investment solutions offered by brokers and mutual funds. We’ve gone back to basics.

Wherewithal was borne from a desire to create new ways to improve the savings and investing experience, and deliver financial advice to the people who need it most—not the multi-millionaire, but those who are just starting out.

I am a finance expert whose professional career has been dedicated to the financial services and investment industry. Having spent over ten years in investment banking advising financial institutions and amassing an insider’s perspective of the industry, I saw a need to redefine the way financial services are delivered to everyday consumers.

Before I founded Wherewithal, I served as a vice president of Houlihan Lokey, a leading international investment bank focused on financial restructuring and middle market M&A, where I was brought in to co-found its Financial Institutions Group. During my career, I have worked on numerous complex transactions, including advisory assignments for the Federal Reserve Bank of New York and the bankruptcy restructuring of Lehman Brothers. Prior to Houlihan Lokey, I worked at Fox-Pitt, Kelton, an investment bank specialized on financial services.

MARKET OPPORTUNITY

Saving money is hard for anyone. Right now, the personal savings rate for Millennials is -2 percent. Wherewithal aims to turn old spending habits into new savings habits.

DIFFERENTIATORS VS. THE COMPETITION

Competitors on the investing side include Betterment, Wealthfront, and FutureAdvisor, to name a few. Unlike these competitors, Wherewithal offers you the ability to save more than you could on your own. No other service offers that. Using Wherewithal is a no-brainer decision.

Competitors on the coupon/rebate side include Ebates, FatWallet, RetailMeNot and Coupons.com. Wherewithal offers you the ability to earn a higher percentage on online purchases plus the ability to automatically save the cash back for your financial goals.

BUSINESS MODEL

Free-to-earn cash back on purchases, $10 a month to invest.

# # #

HEADQUARTERS: New York City

HEADQUARTERS: New York City

WEBSITE: www.getwherewithal.com

FOUNDER: Sam Das

INVESTORS: Bootstrapped

YEAR FOUNDED: 2011

ANGELLIST: angel.co/wherewithal

TWITTER: @getwherewithal

FACEBOOK: facebook.com/pages/Wherewithal/192608147487098

LINKEDIN: linkedin.com/company/wherewithal-llc

CRUNCHBASE: crunchbase.com/organization/wherewithal-llc