Pitbull Ventures, the early-stage venture capital firm founded by prominent investor Brad Zions, today announced the close of its $5M Fund I.

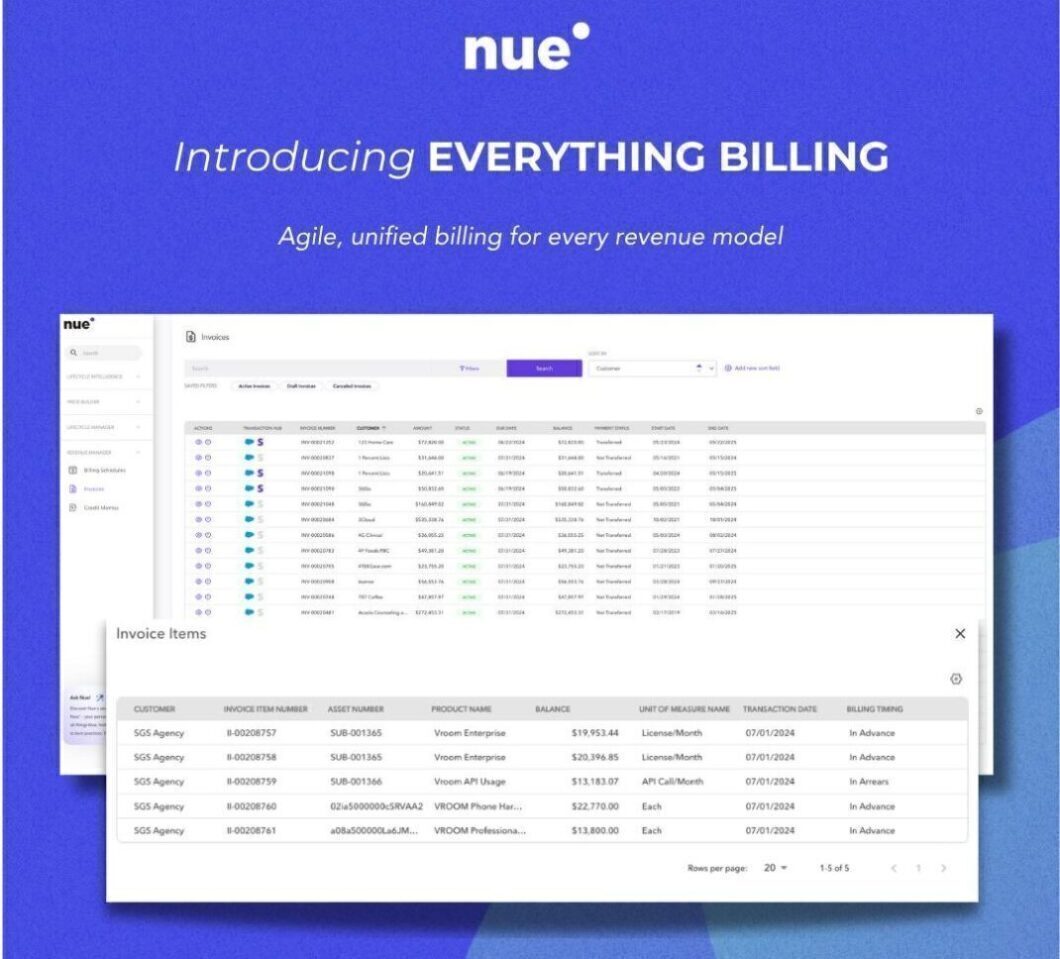

The fund, which is looking to fuel the growth of pioneering startups in the region and take LA’s tech scene to new heights, invests in pre-seed AI-enabled vertical SAAS startups with early traction.

Founder and Managing Partner at Pitbull Ventures, Brad Zions, said, “The launch of our new fund’s closing is thanks to the unwavering dedication of our investment team and the support of our amazing LPs. Now, we’re eager to get into Los Angeles and uncover founders working on the most interesting vertical SaaS solutions across industries that need venture backing in 2024.”

The venture fund has backed 15 vertical SaaS early-stage startups. Investor and entrepreneur Brad Zions has been an active early-stage investor for the past 25 years, both as a partner at Structure Fund and individually, prior to founding Pitbull Ventures in 2021.

Winners in the portfolio include Harri, VidMob, and Embrace, with recent exits including Podsights, Jukin Media, and Donut Media. Previous exits include QXL (IPO) and Google via Ron Conway’s Angel Funds I and II.

Pitbull Ventures is a pre-seed fund focused on industry-vertical SaaS startups, preferring to bet on founding teams that are leveraging AI and have demonstrated early product market fit. The team has invested across a variety of SaaS industries, giving the VC fund a much broader reach, with its portfolio including everything from FinOps to IT distribution services to hospitality tech.