Cyber policy program manager BDI Global and Havoc Shield, a comprehensive cybersecurity program-as-a-service built for small and medium businesses (SMBs), today announced the launch of Shield Up, a cyber risk assessment and remediation platform designed to make cyber liability insurance more accessible to small businesses.

The program is supported by a facility from insurance firm Beazley, and has already accelerated SMB application bind time by an average of 40%, according to a company statement.

The launch announcement comes amid increasing costs and more stringent criteria for small businesses to access cyber insurance coverage. At the same time, attacks are on the rise, with startups and small and medium enterprises (SMEs) three times more likely to be targeted by hackers than larger corporations.

“With Shield Up, we aim to go beyond the current trend of arming [insurance] underwriters with a better risk assessment through scanning technology. We want to help the applicant actually do the homework to fill gaps and become a better risk,” said Brian Fritton, CEO and founder of Havoc Shield.

“Ultimately, this makes small businesses less likely to suffer financial and reputational losses from a breach or ransomware attack. We’ve done this by employing the same award-winning experience we use in our core offering to the often confusing experience of understanding and meeting cyber insurance requirements,” Fritton said.

As the volume and sophistication of cyberattacks has risen over the past few years, smaller companies are finding it more difficult to meet insurance carriers’ rising standards and qualify for cyber insurance coverage.

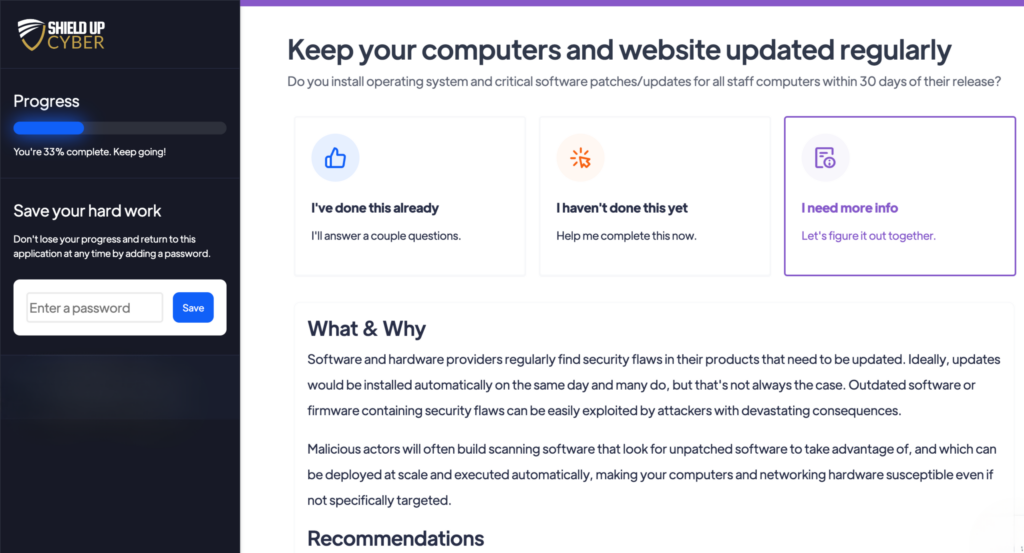

Shield Up’s online portal offers a path for these businesses to quickly understand what IT security controls prevent them from obtaining full and affordable coverage, according to the company.

It allows them to immediately adopt underwriting-vetted solutions provided by Havoc Shield to close those gaps and bind a policy. Shield Up also transforms the underwriting process through automated scanning technology and an automated control verification process, culminating in a streamlined buying experience for insureds and their brokers.

For their part, BDI Global expressed their excitement for the partnership, saying that it offers an opportunity for BDI Global customers and SMBs in general to become more resiliant to cyber threats.

“For over 10 years, BDI Global’s sole focus has been designing and developing cyber risk insurance programs for SMBs,” said Michael Lamprecht, president of BDI Global, in a statement.

“Our partnership with Havoc Shield represents the next evolution of that mission. With Shield Up, we’re not only providing a more accessible path to quality cyber liability insurance – we’re offering small businesses a way to quickly and easily become more resilient to cyber threats.”

Founded in Chicago in 2019, Havoc Shield offers SMB customers a comprehensive security toolset, including enterprise-grade technology and expert support, without paying unaffordable prices or needing to become security experts.

The company went through the 2020 Techstars Chicago cohort and Fritton, the founder, has an extensive background in software engineering and development.