While the Internal Revenue Service has traditionally issued tax refunds via snail mail, in recent years they’ve been pushing for e-filing and direct deposits, which cuts down on delays.

According to the IRS, “Choosing e-file and direct deposit for refunds remains the fastest and safest way to file an accurate income tax return and receive a refund.”

If e-filing is the quickest way to get a refund, why are there still delays? One reason given by the IRS is that it “takes additional time for refunds to be processed after leaving the IRS, and for financial institutions to accept and deposit them to bank accounts and products like debit cards. Also many financial institutions do not process payments on weekends or holidays, which can affect when refunds reach taxpayers.”

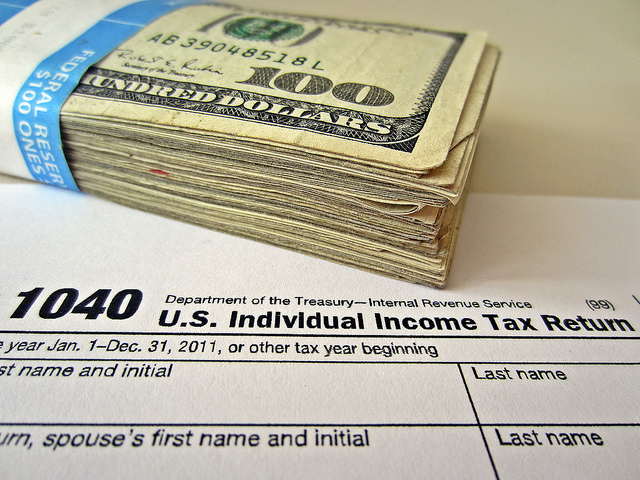

“Where’s my refund?” is the most commonly asked question of the IRS by American taxpayers, yet many are not aware of how their tax returns can be delayed, or why.

Delays on tax refunds can come from accumulated debts, errors big and small, or even pending audits that those who file never knew existed.

When people rely on their annual tax refunds, they expect the money to be in their accounts in order to pay off the rent, mortgages, car payments, or whatever else their needs may be.

According to Matthew Parker of RefundNote, 9 out of 10 refunds are issued within 21 days, but if you are looking at an upwards of 155 million filed in the US in 2018 and 90% of those receiving refunds, this means that an upward of more than 15 million people will experience delays.

The reason for these delays can even be as simple as moving home and not receiving a notification of debt or audit through the postal service.

According to the RefundNote blog, “Each year the IRS sends out thousands if not millions of letters in only one format: The US Mail system. The IRS will not contact you in any other way than by the age old means of stale mail. Due to this fact, it is essential that you keep an accurate address with the agency. If you have not filed your return make sure you enter the current address where you would like to receive mail on the return prior to filing. If you have changed addresses since filing your 2017 tax return, things are a bit more complicated.”

RefundNote offers an automated solution for people whose tax refunds are delayed, so that taxpayers don’t have to go through the slow-moving IRS.

The technology used is a combination of API and a customized machine learning tool that was built in-house, and the process is fast.

“In about 10 minutes we can identify their issues and why they’re experiencing delays,” said Parker. In as little as 30 minutes, users can be funded up to $2,500.

The platform works by users uploading their documents and RefundNote’s automated system pulls data from the IRS database and from the user’s own information.

RefundNote also gives individual taxpayers access to their due tax refund before they’re sent by the IRS. The company also provides advanced financing for users’ tax debts, liens and income taxes due. They do this by assessing factors such as income, historical tax refunds, tax payments, and taxes owed.

It doesn’t matter whether it is an individual or a corporation, the system works for both B2B and B2C. When servicing companies, RefundNote caters to debt investors, retail investors, hedge funds, institutional investors, family offices, and Certified Public Accountants (CPAs).

As opposed to other e-filing companies that don’t help taxpayers beyond filing their returns and waiting for their refunds, RefundNote goes a step beyond.

Most services providers don’t do much outside of helping consumers file and wait, but RefundNote identifies delays, audits, debts, liens, and deductions, which other providers don’t do.

If there is a delay on your tax refund, calling the IRS will not speed things up; however, RefundNote’s automated system can identify the reasons for the delay within 10 minutes.

And for those who are depending upon their tax refunds as part of their annual expenses, every second delayed can seem like an eternity under the crushing uncertainty.

This sponsored story originally appeared on The Sociable.

Image source: 401K Calculator