A Q&A with Bold co-founder and CEO Sean Safahi. The San Francisco-based payments startup, which is focused on on-demand service providers, announced the completion a $2.2 million Seed funding round earlier this year. Investors include Freestyle Capital, Blumberg Capital and Metamorphic Ventures. It was founded in 2013 by Safahi and Noah Spirakus.

Please describe Bold and your primary innovation.

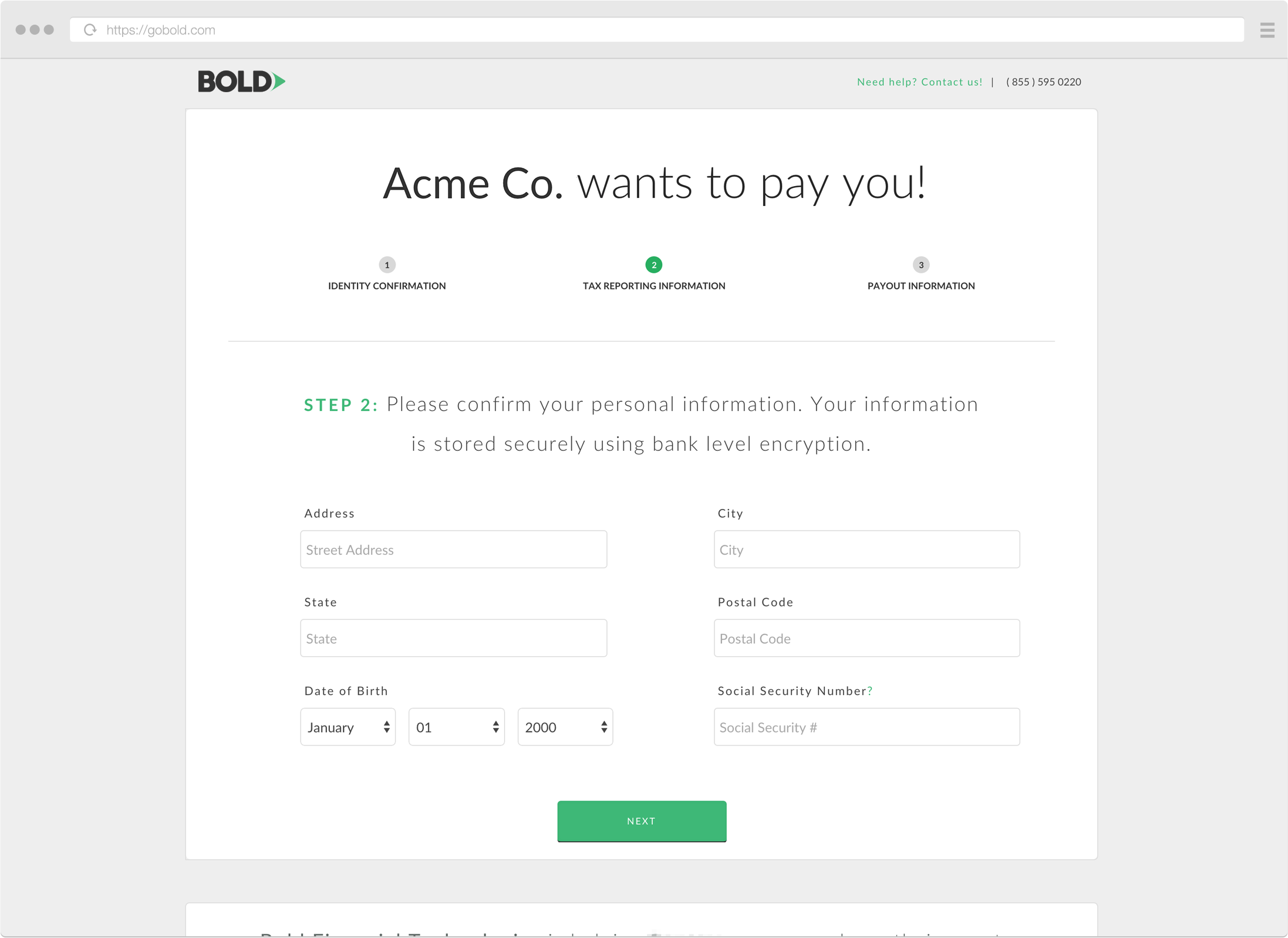

Bold automates all of the complexity around fluid payouts in a dynamic environment, allowing on-demand service providers and marketplace operators to offload technical debt, payment liability, and cost. We provide a full-service payout solution which powers everything from collecting sensitive information from contractors—bank accounts and tax info.—to calculating dynamic payment amounts via an API, facilitating the actual payouts through proprietary bank networks, and maintaining tax compliance.

We encourage our clients to transform their payout cycle to a daily cadence, which is a dramatic improvement over the weekly or bi-weekly cycle that most are on to date.

Who are your target markets and users?

On-demand operators, marketplaces, and their supply-side workers and suppliers.

Who do you consider to be your competition, and what differentiates Bold from the competition?

Bold offers an end-to-end, fully integrated solution. As such, our primary direct competition is a customer that develops an internal platform connecting to numerous endpoints and containing significant technical complexity—think millions of lines of code.

Bold allows for speed-to-solution in a tech-enabled, scalable, compliant, and bank-friendly manner.

You’ve recently revealed that you’ve raised $2.2 million in Seed funding. How have you used and plan to use the funds?

The funds have been deployed, and will continue to be deployed, toward building both a robust infrastructure and a best-in-class product. With a simple setup, we can provide our clients with access to our industry-defining payout and contractor management platform.

What was the inspiration behind the idea for Bold? Was there an ‘aha’ moment, or was the idea more gradual in developing?

As with most things, the ‘aha’ moment stemmed from years of work, frustration, and direct experience. We took a step back, looked at the market and thought to ourselves: “Man, things really should be a lot better than they are. Let’s go do that.” A rather bold notion, if we do say so ourselves.

What were the first steps you took in establishing the company?

Building a team of optimists who look at the world with a unique edge.

How did you come up with the name? What is the story or meaning behind it?

We threw about 100 names on a sheet and projected them onto TV in our original co-working conference room. Next to it, we projected our manifesto, which was riddled with ambitious words, like ‘bold.’ Seeing it in that context, it was clear that there was no other choice.

What have the most significant challenges been so far to building the company?

Navigating the complexity associated with launching a startup and defining a new standard in a highly regulated space. The FinTech market is unique in that it’s ripe with opportunity for innovation, yet also wrought with barriers that hinder it. Most obtrusively, you cannot legally offer your clients an ‘MVP’ until you’ve fully solved the regulatory issue, which delays the typically early cycle of initial product usage, feedback, and iteration.

How do you generate revenue or plan to generate revenue?

We provide a valuable service to our clients by solving a real and painful problem. We generate revenue accordingly. I take a very direct approach to this question: If we create value, we should earn value. If we don’t, then we shouldn’t.

What are your goals for Bold over the next year or so?

Continue to accumulate top, hungry talent; persist with solving complex issues in an elegant way; and create increasingly more value for our clients, customers, shareholders, partners, and the overall ecosystem.